Claiming Mileage Expenses For Work Canada . Web the cra mileage rates are a guide set by the canada revenue agency to reimburse taxpayers for vehicle expenses. Find out how you can take advantage of. Web you can claim motor vehicle expenses if you had to work away from your employer’s workplace or work at multiple. Web if you choose the simplified method, claim in canadian or us funds a flat rate of $23 per meal (for the 2023 tax year), to a. Web using a vehicle for business means you face an intricate set of tax laws when it comes to claiming your expenses. Qualifying for the automobile deduction.

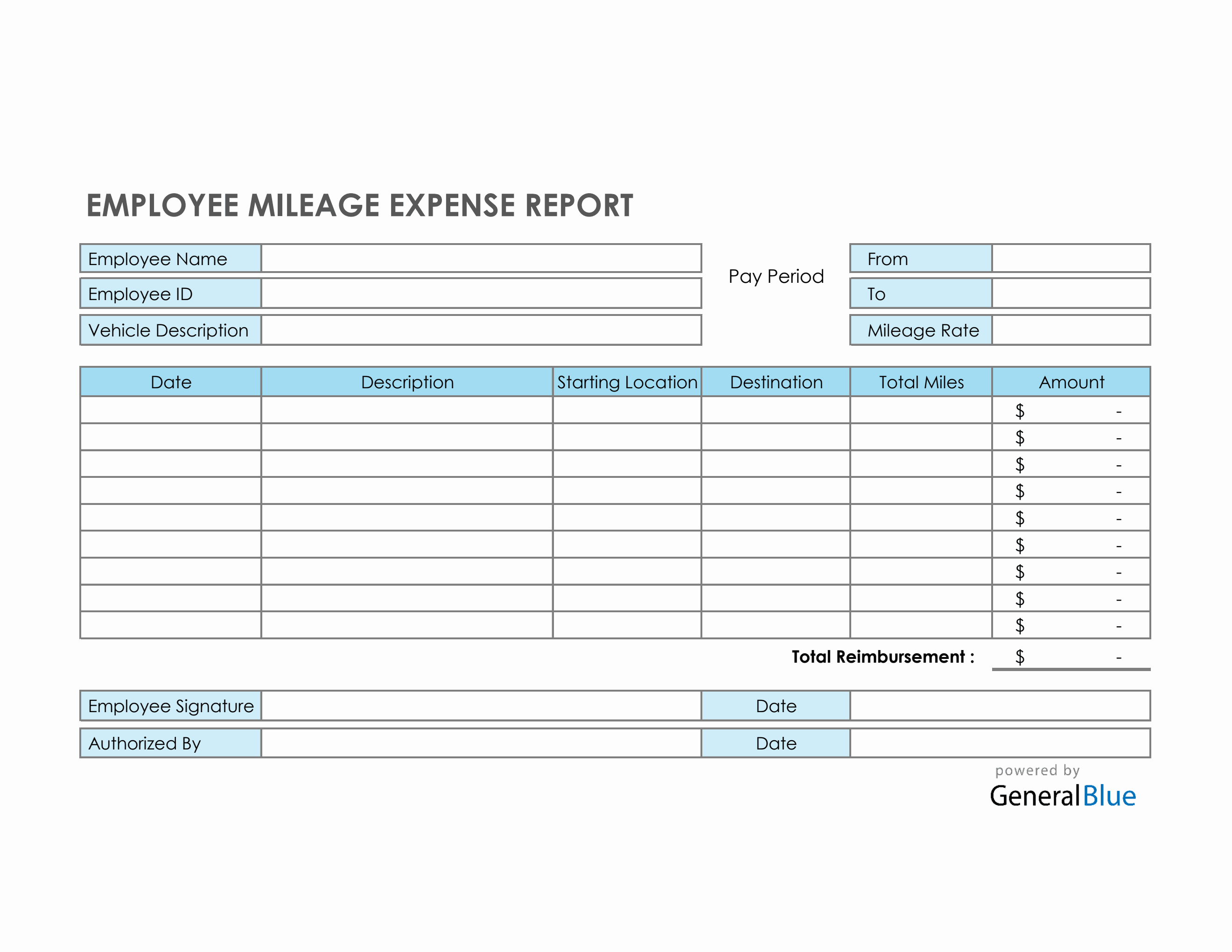

from www.generalblue.com

Find out how you can take advantage of. Web using a vehicle for business means you face an intricate set of tax laws when it comes to claiming your expenses. Qualifying for the automobile deduction. Web if you choose the simplified method, claim in canadian or us funds a flat rate of $23 per meal (for the 2023 tax year), to a. Web you can claim motor vehicle expenses if you had to work away from your employer’s workplace or work at multiple. Web the cra mileage rates are a guide set by the canada revenue agency to reimburse taxpayers for vehicle expenses.

Employee Mileage Expense Report Template in Excel

Claiming Mileage Expenses For Work Canada Web if you choose the simplified method, claim in canadian or us funds a flat rate of $23 per meal (for the 2023 tax year), to a. Web the cra mileage rates are a guide set by the canada revenue agency to reimburse taxpayers for vehicle expenses. Web you can claim motor vehicle expenses if you had to work away from your employer’s workplace or work at multiple. Web if you choose the simplified method, claim in canadian or us funds a flat rate of $23 per meal (for the 2023 tax year), to a. Qualifying for the automobile deduction. Find out how you can take advantage of. Web using a vehicle for business means you face an intricate set of tax laws when it comes to claiming your expenses.

From canadiankilometers.boardingarea.com

Common Mileage Currencies (for Canadians) Aeroplan Canadian Kilometers Claiming Mileage Expenses For Work Canada Web if you choose the simplified method, claim in canadian or us funds a flat rate of $23 per meal (for the 2023 tax year), to a. Find out how you can take advantage of. Web the cra mileage rates are a guide set by the canada revenue agency to reimburse taxpayers for vehicle expenses. Web you can claim motor. Claiming Mileage Expenses For Work Canada.

From www.aspirehiring.ca

The Canadian Labour Shortage FAQs Claiming Mileage Expenses For Work Canada Web using a vehicle for business means you face an intricate set of tax laws when it comes to claiming your expenses. Find out how you can take advantage of. Qualifying for the automobile deduction. Web if you choose the simplified method, claim in canadian or us funds a flat rate of $23 per meal (for the 2023 tax year),. Claiming Mileage Expenses For Work Canada.

From teddiannecorinne.pages.dev

Workers Comp Mileage Reimbursement 2024 Form Zara Anderea Claiming Mileage Expenses For Work Canada Web you can claim motor vehicle expenses if you had to work away from your employer’s workplace or work at multiple. Find out how you can take advantage of. Web the cra mileage rates are a guide set by the canada revenue agency to reimburse taxpayers for vehicle expenses. Web using a vehicle for business means you face an intricate. Claiming Mileage Expenses For Work Canada.

From www.businessaccountingbasics.co.uk

Free Simple Mileage Log Template For Small Business Claiming Mileage Expenses For Work Canada Web you can claim motor vehicle expenses if you had to work away from your employer’s workplace or work at multiple. Web the cra mileage rates are a guide set by the canada revenue agency to reimburse taxpayers for vehicle expenses. Web if you choose the simplified method, claim in canadian or us funds a flat rate of $23 per. Claiming Mileage Expenses For Work Canada.

From www.vrogue.co

Expense Forms Free Printable vrogue.co Claiming Mileage Expenses For Work Canada Web the cra mileage rates are a guide set by the canada revenue agency to reimburse taxpayers for vehicle expenses. Qualifying for the automobile deduction. Find out how you can take advantage of. Web you can claim motor vehicle expenses if you had to work away from your employer’s workplace or work at multiple. Web if you choose the simplified. Claiming Mileage Expenses For Work Canada.

From www.pinterest.com

Mileage Spreadsheet For Taxes in 2021 Mileage chart, Blog business Claiming Mileage Expenses For Work Canada Web using a vehicle for business means you face an intricate set of tax laws when it comes to claiming your expenses. Web the cra mileage rates are a guide set by the canada revenue agency to reimburse taxpayers for vehicle expenses. Web you can claim motor vehicle expenses if you had to work away from your employer’s workplace or. Claiming Mileage Expenses For Work Canada.

From www.pandle.com

Claiming Mileage and Vehicle Expenses for your Business Pandle Claiming Mileage Expenses For Work Canada Web using a vehicle for business means you face an intricate set of tax laws when it comes to claiming your expenses. Qualifying for the automobile deduction. Web you can claim motor vehicle expenses if you had to work away from your employer’s workplace or work at multiple. Find out how you can take advantage of. Web if you choose. Claiming Mileage Expenses For Work Canada.

From old.sermitsiaq.ag

Mileage Expense Template Claiming Mileage Expenses For Work Canada Find out how you can take advantage of. Qualifying for the automobile deduction. Web using a vehicle for business means you face an intricate set of tax laws when it comes to claiming your expenses. Web if you choose the simplified method, claim in canadian or us funds a flat rate of $23 per meal (for the 2023 tax year),. Claiming Mileage Expenses For Work Canada.

From www.belfasttelegraph.co.uk

Many workers denied full mileage BelfastTelegraph.co.uk Claiming Mileage Expenses For Work Canada Qualifying for the automobile deduction. Web using a vehicle for business means you face an intricate set of tax laws when it comes to claiming your expenses. Web the cra mileage rates are a guide set by the canada revenue agency to reimburse taxpayers for vehicle expenses. Find out how you can take advantage of. Web you can claim motor. Claiming Mileage Expenses For Work Canada.

From www.bluedropservices.co.uk

Claiming Mileage Allowance Relief on work based journeys Bluedrop Claiming Mileage Expenses For Work Canada Web the cra mileage rates are a guide set by the canada revenue agency to reimburse taxpayers for vehicle expenses. Qualifying for the automobile deduction. Web using a vehicle for business means you face an intricate set of tax laws when it comes to claiming your expenses. Web you can claim motor vehicle expenses if you had to work away. Claiming Mileage Expenses For Work Canada.

From info.techwallp.xyz

Hmrc Mileage Allowance Management And Leadership Claiming Mileage Expenses For Work Canada Web using a vehicle for business means you face an intricate set of tax laws when it comes to claiming your expenses. Find out how you can take advantage of. Qualifying for the automobile deduction. Web you can claim motor vehicle expenses if you had to work away from your employer’s workplace or work at multiple. Web the cra mileage. Claiming Mileage Expenses For Work Canada.

From www.pinterest.com

Business Mileage Tracker 2019 (Excel) Finance blog, Budgeting worksheets Claiming Mileage Expenses For Work Canada Web if you choose the simplified method, claim in canadian or us funds a flat rate of $23 per meal (for the 2023 tax year), to a. Qualifying for the automobile deduction. Web the cra mileage rates are a guide set by the canada revenue agency to reimburse taxpayers for vehicle expenses. Web you can claim motor vehicle expenses if. Claiming Mileage Expenses For Work Canada.

From freedownloads.net

Download Mileage Expense Report Form PDF Claiming Mileage Expenses For Work Canada Web the cra mileage rates are a guide set by the canada revenue agency to reimburse taxpayers for vehicle expenses. Find out how you can take advantage of. Web if you choose the simplified method, claim in canadian or us funds a flat rate of $23 per meal (for the 2023 tax year), to a. Qualifying for the automobile deduction.. Claiming Mileage Expenses For Work Canada.

From www.generalblue.com

Employee Mileage Expense Report Template in Excel Claiming Mileage Expenses For Work Canada Web the cra mileage rates are a guide set by the canada revenue agency to reimburse taxpayers for vehicle expenses. Web using a vehicle for business means you face an intricate set of tax laws when it comes to claiming your expenses. Qualifying for the automobile deduction. Find out how you can take advantage of. Web you can claim motor. Claiming Mileage Expenses For Work Canada.

From nationalgriefawarenessday.com

Excel Mileage Log Template Business Claiming Mileage Expenses For Work Canada Qualifying for the automobile deduction. Web the cra mileage rates are a guide set by the canada revenue agency to reimburse taxpayers for vehicle expenses. Web using a vehicle for business means you face an intricate set of tax laws when it comes to claiming your expenses. Web if you choose the simplified method, claim in canadian or us funds. Claiming Mileage Expenses For Work Canada.

From whoamuu.blogspot.com

Monthly Mileage Log Template HQ Printable Documents Claiming Mileage Expenses For Work Canada Web the cra mileage rates are a guide set by the canada revenue agency to reimburse taxpayers for vehicle expenses. Web using a vehicle for business means you face an intricate set of tax laws when it comes to claiming your expenses. Web you can claim motor vehicle expenses if you had to work away from your employer’s workplace or. Claiming Mileage Expenses For Work Canada.

From www.tripcatcherapp.com

Your Guide to Claiming Mileage Expenses Tripcatcher Claiming Mileage Expenses For Work Canada Web the cra mileage rates are a guide set by the canada revenue agency to reimburse taxpayers for vehicle expenses. Qualifying for the automobile deduction. Web if you choose the simplified method, claim in canadian or us funds a flat rate of $23 per meal (for the 2023 tax year), to a. Web you can claim motor vehicle expenses if. Claiming Mileage Expenses For Work Canada.

From kinnamaribelle.pages.dev

Irs W4p 2024 Ilse Rebeca Claiming Mileage Expenses For Work Canada Web if you choose the simplified method, claim in canadian or us funds a flat rate of $23 per meal (for the 2023 tax year), to a. Find out how you can take advantage of. Web the cra mileage rates are a guide set by the canada revenue agency to reimburse taxpayers for vehicle expenses. Qualifying for the automobile deduction.. Claiming Mileage Expenses For Work Canada.